Written for Business Monthly - June 2023 Issue

MARKET WATCH

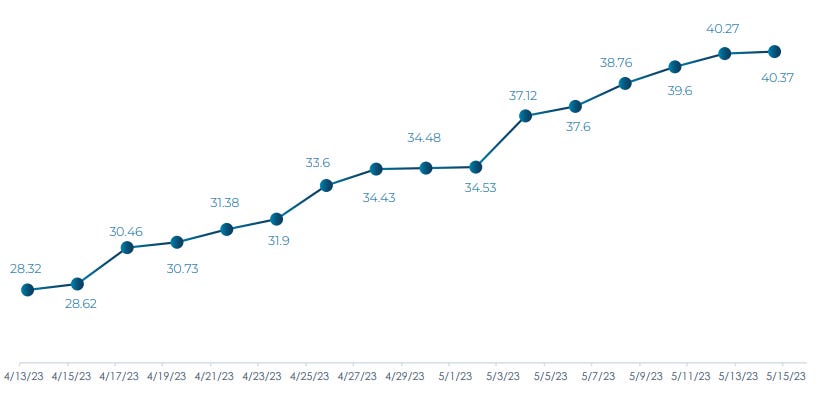

The market took a breather in the April 15 to May 15 period, which had fewer trading days due to Eid El-Fitr. Still, year-to-date gains were sustained. The EGX 30 and EGX 70 EWI ended up 17.4% and 8.4%, respectively. However, the main index’s heavyweights were down 3%, and the EGX 70 EWI was up 2.3%. CIB (COMI, down 11%), Egypt Kuwait Holding Co. (EKHO, down 12%), and EIPICO (PHAR, down 15%) all fell, while Delta Sugar (SUGR, up 43%), Misr Hotels (MHOT, up 36%), Ibnsina Pharma (ISPH, up 32%) and Credit Agricole Egypt (CIEB, up 31%) rose. The market was almost evenly split between advances and declines.

The period was full of events that drove the market performance. All three major rating agencies turned negative on Egypt over concerns about its ability to pay off its mounting external debt amid pressure on the Egyptian pound. S&P revised its outlook to negative from stable, although it affirmed its B rating. Also, Fitch Ratings downgraded Egypt from B+ to B, with a negative outlook. Even Moody’s placed Egypt’s B3 rating under review for a possible downgrade. Agencies also cited slow implementation of economic reforms.

But the Egyptian government partially cut off diesel subsidies, raising its price by 14% in early May. The government also kicked off its privatization program with two transactions, albeit not as sizable as investors would have hoped. First, over 80% of PACHIN’s (PACH) shareholders agreed to sell to U.A.E.-based National Paints Holding at EGP39.8 per share, including the Egyptian government. Second, the government sold a 9.5% stake in Telecom Egypt (ETEL) for EGP23.11 per share and a total of EGP3.95 billion.

As for other corporate events, quarterly results were strong across many sectors. For instance, banks continued to report strong earnings, led by COMI which reported yet another all-time high quarterly net income of EGP6 billion. Elsewhere, Taaleem Management Services’ (TALM, up 21%) net profits rose 38% year-on-year in its first-half ended in February on higher revenues and improved margins. Egypt Aluminum (EGAL, up 19%) and Sidi Kerir Petrochemicals (SKPC, up 8%) both reported strong 9-month earnings growth of 132% and 107%, respectively, thanks in part to a stronger U.S. dollar.

Meanwhile, with urban inflation cooling off from an annual rate of 32.7% in March to 30.6% in April, the Central Bank decided on May 18 to keep key policy rates unchanged, which was widely expected. However, what is really difficult to expect is how the Egyptian pound will fare vis-à-vis the U.S. dollar over the coming period.

STOCK ANALYSIS

Delta Sugar (SUGR)

Delta Sugar (SUGR) was the top performer during the period, up 43%. The company, which produces beet sugar, delivered outstanding earnings in 2022 and more recently in the first quarter of 2023. The company reported earnings of EGP324 million, up a staggering 321% year-on-year, driven by 29% higher revenue of EGP775 million and a wider gross profit margin of 30%, in addition to a huge FX gain of EGP216 million vs. only EGP10 million the previous year. By end of the period, the stock was up 86% on a year-to-date basis before losing some of its steam.