Written for Business Monthly - July 2023 Issue

MARKET WATCH

On a year-to-date basis, the market has been evenly split between large- and small-cap stocks. By June 15, the former (as measured by the EGX 30) was up 22.5%, while the latter (as measured by EGX 70 EWI) was up 23.7%. However, small-cap stocks played catch-up during the May 15 to June 15 period, rising 14.1% vs. only 4.4% for large-cap stocks.

A closer look at the period’s movers points to the outstanding performance of Beltone Financial Holding (BTFH, up 119%, adjusted for its rights issue), which called for a capital increase of EGP 10 billion ($323.6 million), almost 11 times its current capital. Cairo Poultry (POUL, up 22%), another EGX 70 EWI component, reported outstanding financial results in the first quarter as earnings rose more than 10 times yearly. That was driven by higher selling prices and wider margins, as companies benefited from low-cost inventory accumulated during 2022.

Still, all was not rosy for the EGX 70 EWI. State-owned Egypt Aluminum (EGAL, down 7%) and Alexandria Containers Handling (ALCN, down 9%) fell as investors took some profits off the table. Since the start of the year, both were still up 50% and 23%, respectively. Meanwhile, B Investments (BINV, down 24%) fell after going ex-dividend and following a profit-taking wave. The stock was still up 23% year-to-date. Following the end of the period, BINV made an all-share offer to acquire 51%-90% of Orascom Financial Holding (OFH, up 15%)— another EGX 70 EWI component.

In the meantime, off-index bets paid off for investors who held on to MOPCO (MFPC, up 31%) after the stock rose the daily limit of 20% twice in a row. On the first day, June 12, the exchange had a technical issue that halted trading by 12:31 pm. MFPC was already up 20% by then, which made some investors speculate that this was behind the glitch.

Another off-index bet was Qalaa Holdings (CCAP, up 29%), which was bid higher after its 55.3%-owned subsidiary TAQA Arabia (TAQA) listed its shares on the Egyptian Exchange and was set to start trading immediately. However, the company decided to delay trading until after Eid Al-Adha.

Speaking of which, investors began to cool a bit ahead of the seven-day Eid Al-Adha vacation. In the summer, investors usually go on holidays and reduce their market exposure. The stock market adage “sell in May and go away” may not necessarily hold this year, especially with the government keen on executing its ambitious company offerings program. Only then might some investors cut their vacations short.

STOCK ANALYSIS

Beltone Financial Holding (BTFH)

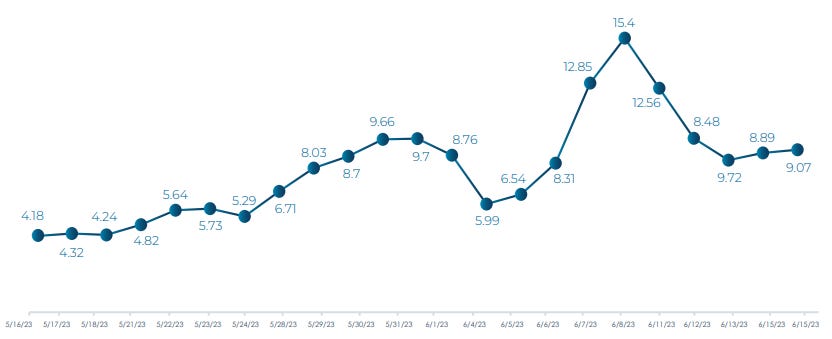

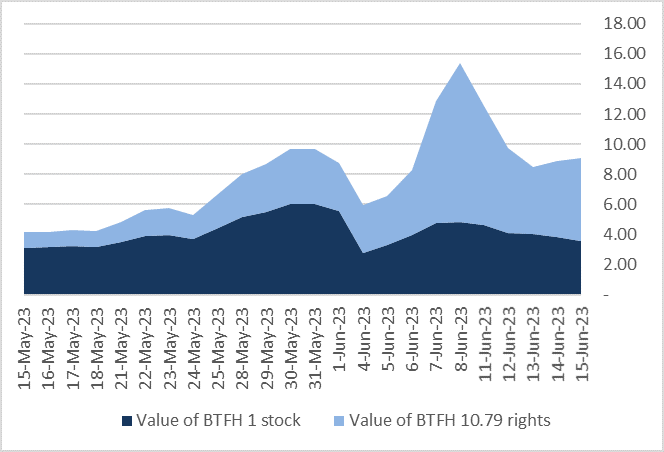

Now and then, some stocks deliver unexpected abnormal returns. Beltone Financial Holding (BTFH), for instance, finally called for its planned EGP 10 billion capital increase, one of the largest in the market’s history. While capital increase calls usually have a negative connotation, it was totally different for BTFH as the stock and capital increase rights rose in tandem. To calculate stock performance, one must consider the 10.79 rights at their theoretical price. That means BTFH stockholders would have seen portfolio values jump 119% during the period after hitting a high of 272% on June 8.