MARKET WATCH — Keyword: Fertilizers

STOCK ANALYSIS: Misr Fertilizers Production Co. “MOPCO” (MFPC)

Written for Business Monthly - November 2023 Issue

MARKET WATCH

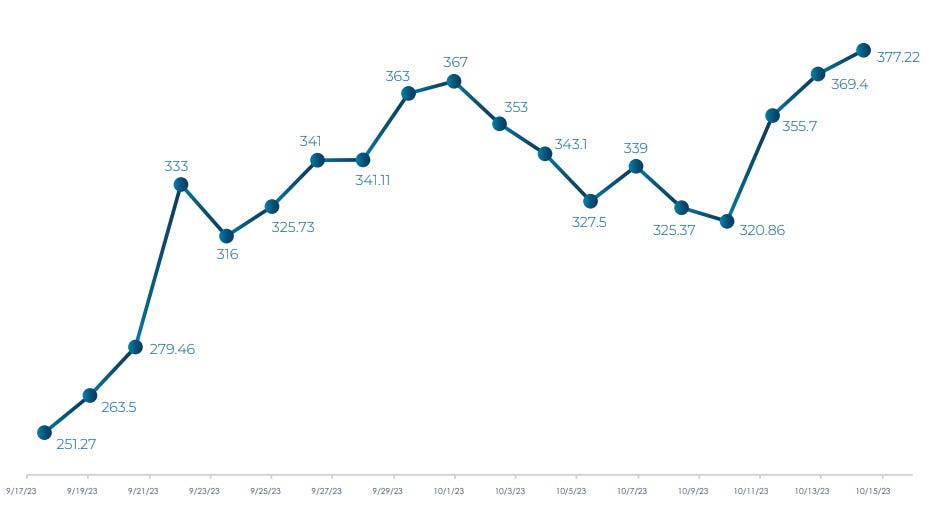

After EGX 70 EWI underperforming for most of the second quarter of 2023, the market's bellwether EGX 30 finally began to stage a comeback in the third quarter. And no, it was not CIB (COMI) that led the index performance from Sept. 15 through Oct. 15. CIB rose only 1.3%, while the EGX 30 rose 4% and the EGX 70 EWI fell 2.3%. The EGX 30 performance was led by some usual suspects, such as Orascom Construction (ORAS, up 56%) and Ezz Steel (ESRS, up 17%). The EGX 30 performance came despite declines outnumbering advances by 80%.

But the keyword during the period was "fertilizers." Almost all stocks linked to fertilizers rose, possibly because of exports. Indeed, Samad Misr (SMFR, up 124%), Misr Fertilizers Production Co. (MFPC, up 75%), Abu Qir Fertilizers (ABUK, up 28%), Kima (EGCH, up 24%) and International Agricultural Products (IFAP, up 22%). There was no explanation for the sector's outperformance, especially with neither urea prices nor the exchange rate moving much. Even IFAP, which has exposure to phosphate fertilizers, rose, while Egyptian Financial & Industrial Co. (EFIC) fell 4%. As Isaac Newton once said, sometimes the madness of the people is incalculable.

Elsewhere, the "export-linked companies" theme seemed to be playing: ORAS, Alexandria Containers Handling (ALCN, up 35%), Delta Sugar (SUGR, up 32%), Misr Chemical Industries (MICH, up 22.5%). Even Misr Hotels (MHOT, up 21%) extended its previous gains. Ironically, other export-linked names were lagging by the end of the period, such as Ezz Ceramics (ECAP, up 5%), Lecico Egypt (LCSW, up 4%), and Alexandria Mineral Oils Co. (AMOC, up 3%). Meanwhile, the year's top performer through 2023 was Memphis Pharmaceuticals (MPCI, up 254%), followed by commodity-related stocks, namely SMFR (up 236%), MFPC (up 235%), SUGR (up 173%), ESRS (up 157%) and Sidi Kerir Petrochemicals (SKPC, up 150%).

During the period, the Central Bank of Egypt kept its key policy rates unchanged, although inflation continued to rise. But the market seems to be stepping into the "shopping season," where foreign investors often pick and choose companies to pursue for acquisition. On the one hand, foreign investors are looking for highly profitable, high-growth companies that can withstand Egypt's macroeconomic issues. On the other hand, the Egyptian government is looking to sell critical assets to raise foreign currency. It's just a matter of time until some deals are revealed.

STOCK ANALYSIS

Misr Fertilizers Production Co. “MOPCO” (MFPC)

Picture this. Misr Fertilizers Production Co. started t with a market cap of EGP 58 billion, but EGP 100 billion at the end of the period. Later, the stock hit an all-time high of EGP 637, valuing MOPCO at a whopping EGP 146 billion. MOPCO had no significant news except its decision to merge with its wholly-owned subsidiary, Egyptian Nitrogen Products Co., using a 9-to-1 share swap. The stock rose 75%, with 5 million shares (only 2% of outstanding shares) worth EGP1.75 billion changing hands.