MARKET WATCH — Geopolitics drove volatility higher

STOCK ANALYSIS: Misr Beni Suef Cement (MBSC)

Written end of June 2025 for Business Monthly - July 2025 Issue

MARKET WATCH

The period from May 15. to Jun. 15 was very volatile with the local stock market taking a hit, along with other Arab stock markets. This was a direct result of the Israel-Iran conflict. EGX 30 (down 2.9%) and EGX 70 EWI (down 3.3%) both fell, but they were nonetheless up 4.3% and 11.8%, respectively, for the year. Still, volatility unnerved many investors who ran for the exits. We now know in hindsight that overall global and local markets recovered, but at the time of the crisis, uncertainty overtook some investors’ rationale. Overall, declines outnumbered advances by a ratio of 3 to 1 during the period.

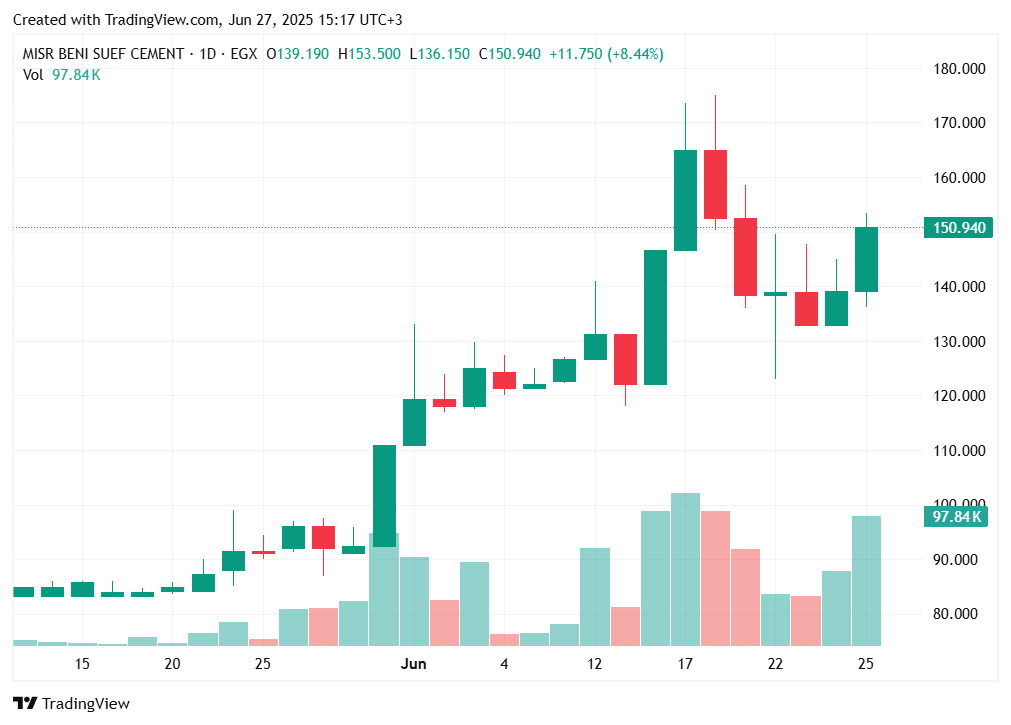

Building materials, specifically cement, stocks rose as a sector, led by Misr Beni Suef Cement (MBSC, up 47%), Misr Cement (MCQE, up 34%), South Valley Cement (SVCE, up 23.5%), and Arabian Cement (ARCC, up 19%). Similarly, milling stocks came back under the limelight, possibly as we approach its annual dividend season. They were led by Upper Egypt Flour Mills (UEFM, up 42%) and North Cairo Flour Mills (MILS, up 21%).

The last day of the period marked the ex-dividend date of EFG Holding (HRHO, down 6%) with regards to the in-kind distribution of 20.5% of Valu, its majority-owned consumer finance arm. HRHO fell more than 12% on that day. That day also marked the first trading day for the Egyptian stock market following the Israeli attack on Iran, which resulted in a heightened level of uncertainty around the world, including neighboring Arab markets. EGX 30 and EGX 70 EWI fell 4.6% and 5.2% after paring their losses for the day.

Similarly, Beltone Holding (BTFH, up 30%) extended its year-to-date positive performance to 42.5%. It appears that the non-banking financial services (NBFS) stocks were buoyed by the Central Bank of Egypt’s (CBE) decision on May 22 to cut benchmark EGP interest rates by 100 basis, the second in a row, bringing total rate cuts since the start of the year to 325 basis points. Investors are hoping that this would help reduce NBFS’s cost of funding down the road. However, the May inflation reading came in slightly higher than expected, making investors question the pace at which the CBE will continue to cut rates, especially amid more uncertainties around the Middle East.

In this context, global and regional markets appear to have absorbed the recent U.S. attack on Iran's nuclear sites, effectively curtailing Iran's ambitions to develop nuclear weapons—at least for the time being. However, the extent to which Iran's nuclear capabilities have been "obliterated" remains uncertain, leaving the situation not totally resolved.

STOCK ANALYSIS

Misr Beni Suef Cement (MBSC)

Misr Beni Suef Cement (MBSC) was another hot cement stock that more than doubled (up 122%) since the start of the year. The company increased its stake in Misr Cement Qena (MCQE), another local cement manufacturer, from 0.65% to 11.03%, yet another merger and acquisition activity within the cement sector. That stake came mostly from Al-Ahly Capital Holding which sold off its entire 10% stake in MCQE. MBSC acquired the additional stake in MCQE at around EGP30 a share, after which the stock rose to as high as EGP46 early June. Later, MCQE fell in view of the Israel-Iran conflict before recovering all of its losses as MBSC fell on profit-taking activity. Still, MBSC was up 47% during the period.