MARKET WATCH — As good as it gets

STOCK ANALYSIS: U for Consumer Finance “Valu” (VALU)

Written end of July 2025 for Business Monthly - August 2025 Issue

MARKET WATCH

The period from Jun. 15. to Jul. 15 was as good as it gets, thanks to more subdued geopolitical tensions that marred the market performance in the prior period. Following a negative performance in the prior month, all main market indices ended this period higher. The EGX 30 added 9.4% to 33,934.6, and the EGX 70 jumped 11.6% to 10,166.1. As such, both indices extended their year-to-date gains to 14.1% and 24.8%, respectively. In terms of sector performance, it was led by consulting & engineering, while travel led the underperformers.

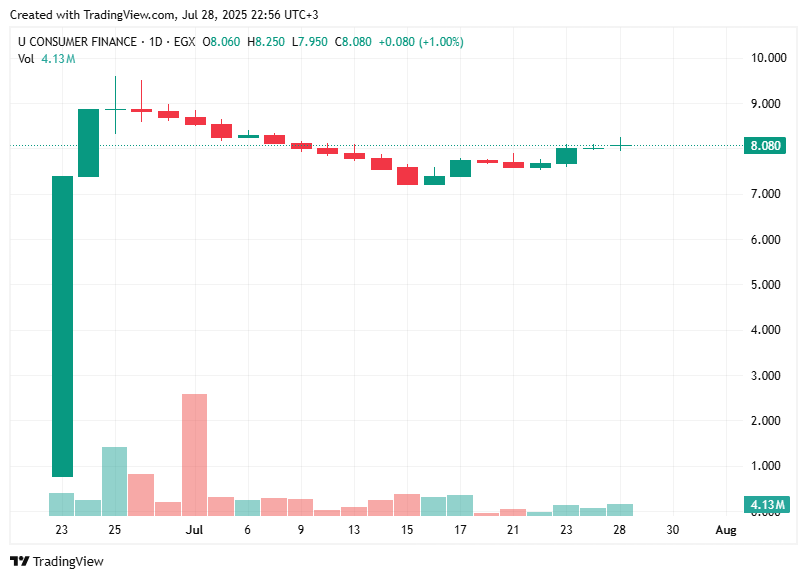

The period marked the trading debut of U for Consumer Finance, otherwise well known for its brand name Valu (VALU), one of EFG Holding’s (HRHO) subsidiaries. The stock started its trading with a strong euphoria, having jumped to its maximum allowed levels on two consecutive days. Later on, investors traded the stock lower as they took some of their gains off the table.

Also, this period marked the start of the subscription process of Bonyan for Development & Trade’s (BONY) EGP1.8-billion initial public offering (IPO), Egypt’s first in 2025. BONY, tapping a new real estate investment segment, was marketed as one of the ways to gain exposure to the real estate sector but from a long-term investor’s view. This is because BONY’s value is derived from its recurring rents.

Another company-specific performance was related to Orascom Construction (ORAS, up 40% to EGP378). It reacted positively to the news that a rather limited settlement amounting to USD28.7 million was charged against one of ORAS’s subsidiaries’ joint ventures. The market seems to have been discounting this potential outlay, which is why the stock reacted positively to the news.

Elsewhere, the other Orascom stocks posted some stellar performance with no news justifying their performance. Orascom Investment Holding (OIH, up 25% to EGP1.09) and Orascom Financial Holding (OFH, up 24% to EGP0.639) both rose in double digits this period. Meanwhile, Contact Financial Holding (CNFN, up 25% to EGP5.60), around 30% owned by OFH, also rose.

On the other end of the spectrum, Premium Healthcare Group (PHGC, down 34.5% to EGP0.175) began to give in some of its earlier gains. It started falling in a downtrend before even its new shares from its latest capital increase were made available.

As for the macro picture, in its meeting on Jul. 10, the Central Bank of Egypt (CBE) decided to keep rates unchanged, in line with the market’s forecast. This, along with other internal and external factors, may have helped the Egyptian pound gain some ground against the U.S. dollar. It rose more than 2% during the period.

STOCK ANALYSIS

U for Consumer Finance “Valu” (VALU)

Marking the first of its kind in the Egyptian stock market, EFG Holding (HRHO) decided to directly list Valu (VALU), one of its subsidiaries, on the Egyptian Exchange. To do so, HRHO distributed around 431.5 million shares (a 20.488% stake) to its shareholders as of Jun. 12 at a ratio of 0.3005 VALU share for each HRHO share. The reference price was VALU’s book value as of Dec. 31, 2024 of EGP0.777/share. This explains why VALU appeared to have jumped more than 850% on Jun. 23, its first trading day. VALU hit a high of EGP9.50 intraday on Jun. 29 (a market cap of some EGP20 billion) before falling 24% to settle at EGP7.22.