Written end of January 2025 for Business Monthly - February 2025 Issue

MARKET WATCH

The year 2024 marked the fourth year in a row where both main market indices delivered positive rates of return, albeit in Egyptian pound terms. In 2024, the EGX 30 and the EGX 70 EWI rose by 19.5% and 48.8% to end the year at 29,741 and 8,143, respectively. Both indices managed to register double-digit annual returns in the last three years. However, in EGP terms, both indices were down for the year by 27% and 10%, respectively. So far into 2025 through Jan. 15, the EGX 30 fell 1.2%, while EGX 70 EWI fell 0.3%.

The top performers’ list in 2024 was led by somewhat obscure names that are not widely followed by the market, namely Sharkia National Food Co. (SNFC), which we featured in last month’s issue. No wonder then that small caps as measured by EGX 70 EWI outperformed large caps as measured by EGX 30.

Meanwhile, the period from Dec. 15 to Jan. 15 saw both indices pulling back. The EGX 30 fell 4.5%, and the EGX 70 EWI fell 5.7%. In fact, the month of December, which has been mostly a positive month for both indices, was negative in 2024 for the first time since 2020 in the case of EGX 30 and since 2019 in the case of EGX 70 EWI.

Nonetheless, the market did not run out of stock rallies just yet. For instance, South Cairo & Giza Mills (SCFM) more than doubled during the period, jumping 103% to EGP72.44. And as usual, the company denied any material events that may have triggered such a performance which came with an above-average trading volume. One of the few companies that report their earnings on a monthly basis, SCFM continued to report net losses. After reporting a net loss of EGP1.3 million in its first quarter ended 30 Sep. 2024, it reported another monthly loss in its second quarter with a net loss of EGP0.6 million in November 2024 versus a net income of EGP4.3 million a year before without giving a reason for the losses.

On the other hand, Marseilia Egyptian Gulf Real Estate Investment (MAAL) tailed the list, down 24% to EGP3.18. The real estate developer’s board of directors approved to raise its capital by EGP96.2 million through a cash injection and initially approved to participate in a Saudi company as part of its regional expansion plan. The company, which reported a net loss of EGP22 million in its 9-month results, said it managed to reverse it to a net profit of EGP9.1 million as of 23 Dec. 2024.

Meanwhile, the macro picture was more or less unchanged, with the exception of the exchange rate. The Egyptian pound weakened against the U.S. dollar towards the end of 2024, ending the year at around EGP50.9 before recovering marginally to EGP50.5 by the end of the period.

STOCK ANALYSIS

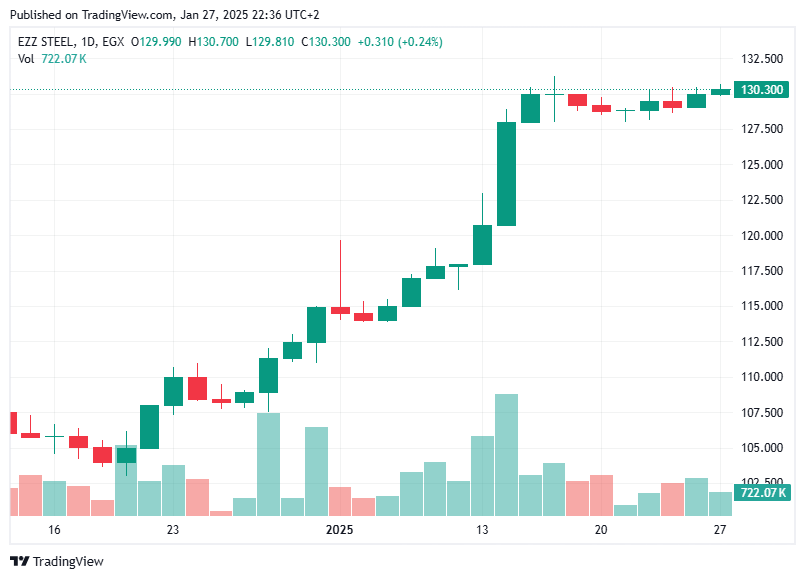

Ezz Steel (ESRS)

Ezz Steel (ESRS), the region’s largest steel manufacturer, wanted to leave the Egyptian Exchange and the London Stock Exchange and go private. Initially, the company offered its shareholders who were opposed to the delisting of its shares a maximum of EGP120 a share, which represented a premium of 36% to its average price during 2024 which was EGP88.43. However, an independent financial advisor (IFA) later on valued ESRS at EGP138.15 a share. During the period, the stock rose 23% to EGP130 after the company came back on Jan. 14 and decided to up its offer to the IFA’s valuation.