MARKET WATCH: A Grand Finale

STOCK ANALYSIS: Egyptian Media Production City (MPRC)

Written for Business Monthly - February 2023 Issue

MARKET WATCH

What a finale for a very volatile year! Both EGX 30 and EGX 70 EWI ended the year with double-digit positive returns, 22.2% and 27.3%. For EGX 30, it was the second year in a row of double-digit positive performance. Throughout most of the year, both indices were in the red zone with double-digit negative performance. Their luck did not change until the very end of 2022, and it was the second round of devaluation of the Egyptian pound that made the difference. As the Egyptian pound depreciated, stocks became even cheaper, which attracted investors.

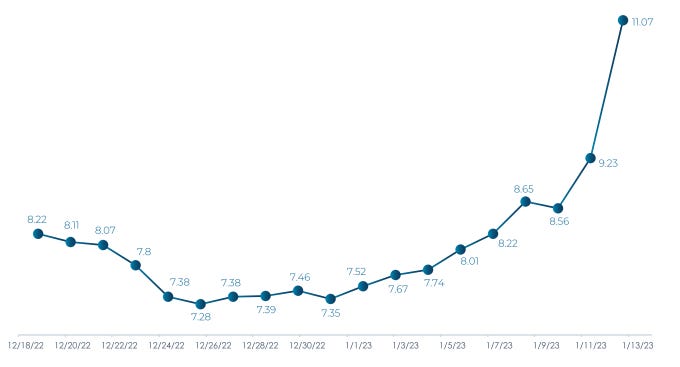

Meanwhile, the Dec. 15 to Jan. 15 period was affected by some profit-taking activity, as the EGX 30 inched up 2.8% to 15,561.3 while EGX 70 EWI slipped 0.8% to 2,840.1. It was still an event-driven market, with M&A news taking the front seat. Investors have been taking some profit off the table, especially in some large-cap stocks, such as CIB (COMI, -8.2%) and EFG Hermes Holding (HRHO, -4.2%) which had been rising because of a stronger U.S. dollar and higher yields. HRHO owns a 51% stake in aiBank. Similarly, investors bid other small-cap stock prices higher, such as Media Production City (MPRC, +34%). The company was rumored to be part of a restructuring plan that may see the government, its main shareholder, divest part of its stake.

Also, GB Auto, which rebranded to GB Corp (AUTO), saw its stock slip 1.1%. The group has been monetizing some of its investments, such as selling a 45% stake in GB Capital to UAE-based Chimera Investments for EGP855 million, leaving it with a 55% stake. On a different note, with the Egyptian government looking to divest some of its assets to shore up needed U.S. dollar inflows, investors looked for stocks that could be positively affected. Heliopolis Housing & Development (HELI) was one of those stocks rumored to be part of a bigger plan where its main shareholder, the state-owned Holding Co. for Construction, could be monetizing its majority stake in HELI. The stock rose some 34.5% during the period.

As for the macro picture, while a high-interest rate environment is often a drag on stocks, a weaker pound is generally positive. On Jan. 4, the Central Bank of Egypt (CBE) allowed the pound to depreciate one more time. A week later, it hit an intraday and an all-time high of EGP32.2 per U.S. dollar before pulling back to trade sub-30 for the remainder of the period. With inflation accelerating to 21.3% in December from 18.7% in November, investors will be weighing how hawkish the CBE could be in 2023.

STOCK ANALYSIS

Egyptian Media Production City (MPRC)

Until recently, Egyptian Media Production City (MPRC) has long been neglected by investors. A retail investor favorite, the company has seen its stock jump some 34% by the end of the period to last trade at EGP11.07, surpassing its EGP10 par value for the first time since 2008. With a target net income of EGP324.5 million in 2023, the company’s stock was trading at just 6.5 times forward earnings by the end of the period.