Written for Business Monthly - November 2022 Issue

MARKET WATCH

Back to Earth

The market took a breather with its two main indices slipping during the period from September 15 to October 15. Both EGX 30 and EGX 70 EWI fell by 2.2 percent and 5.1 percent to 9,853.7 and 2,151.9, respectively. While the two indices are still down on a year-to-date basis (-17.5 percent and -2.3 percent), they are up over the last three months (+12 percent and +27 percent)—both respectively. Declines outnumbered advances by a ratio of 2 to 1.

As usual, QNB Alahli (QNBA) kick-started the third quarter earnings season, posting a 7-percent growth in net income to EGP2.5 billion. Later on, Obour Land for Food Industries (OLFI) posted strong results, hitting its highest-ever quarterly net profits and revenues, with revenues exceeding the EGP1-billion mark to EGP1.34 billion (up 64 percent year-on-year) and earnings growing to EGP146mn (up 31 percent year-on-year). Also, Egypt Aluminum (EGAL) reported a historic jump in net income to EGP2.5 billion versus only EGP28 million a year earlier as revenues grew on significantly higher aluminum prices as well as a stronger U.S. dollar.

Financial and strategic investors have been busy snapping up stakes in both listed and unlisted companies in view of cheap market valuations. For instance, Kuwait’s sovereign wealth fund, through Ekuity, increased its stake in Rameda (RMDA) from 2.8% to 8.2% at an average price of EGP2.96/share. On the other hand, the Saudi Public Investment Fund (PIF), through its wholly-owned subsidiary Saudi Egyptian Investment Co. (SEIC), bought a 34-percent stake in electronics retailer B.TECH for reportedly USD150 million. Also, Sustainable Capital Africa Alpha Fund raised its stake in Orascom Construction (ORAS) from 15.13% to 16.16%. Elsewhere, Egypt Kuwait Holding Co. (EKHO) launched a one-year USD20-million share buyback program (representing 1.5% of its market capitalization) applicable to its shares traded in either U.S. dollar or Egyptian pound. Similarly, Elsewedy Electric (SWDY) extended the period for its share buyback program through 5 January 2023. Alternatively, Sidi Kerir Petrochemicals (SKPC) is studying the full acquisition of its 20%-owned Ethydco through a share swap.

As for macro news, investors were still awaiting the finalization of the discussions between the Egyptian government and the IMF concerning a new support package. Meanwhile, the Egyptian government vowed to raise as much as USD6 billion by selling stakes in state-owned assets by mid-2023. As such, the Sovereign Fund of Egypt plans to float oil marketing company Wataniya and water bottler Safi on the EGX, both of which are currently being restructured. Indeed, until more liquidity is pumped into the market, foreign investors will likely be tiptoeing around Egyptian stocks.

STOCK ANALYSIS

Qalaa Holdings (CCAP)

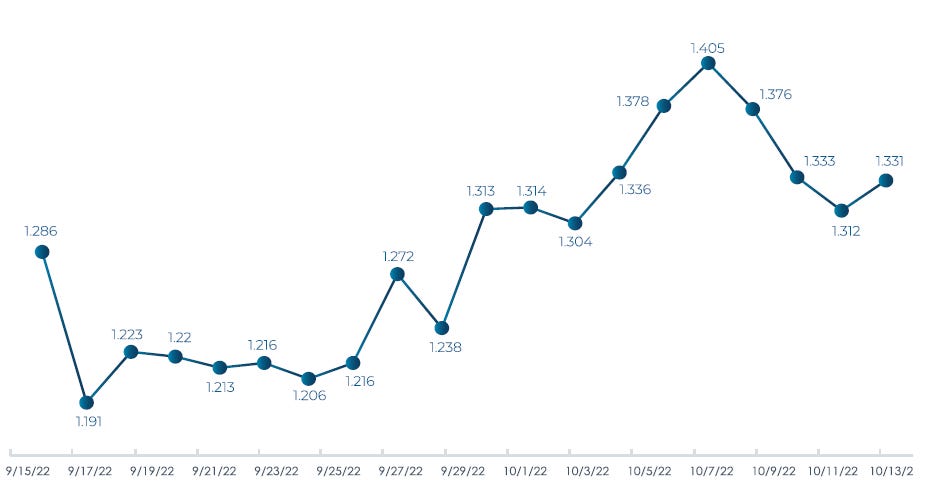

Qalaa Holdings (CCAP) managed to turn back to profitability with a net income of EGP362 million in the second quarter vs. a net loss of EGP402 million a year earlier. With a 13.1 percent effective stake, Egyptian Refining Company (ERC) drove CCAP’s earnings improvement in view of gross refining margin doubling to USD5.4 million a day versus the quarter before. Strong revenue growth and wide spreads between high-sulfur fuel oil and low-sulfur fuel oil helped margins expand. CCAP’s stock rose 3.5 percent during the period to EGP1.33, extending its year-to-date gain to 10.4 percent.